Tax Accounting and Finance with Xero Accounting & Bookkeeping

3 Courses Bundle | CPD Certified Diploma | FREE PDF Certificates | FREE Exam | 24/7 Tutor Support | Lifetime Access

Janets

Summary

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- Exam(s) / assessment(s) is included in price

Add to basket or enquire

Overview

Do you want to become an expert in accounting, bookkeeping, and taxation? This comprehensive Tax Accounting and Finance with Xero Accounting & Bookkeeping bundle equips you with the in-demand skills to advance your finance career.

You'll begin with a deep dive into Xero - the leading accounting software for small businesses. Master all key features, from generating invoices to reconciling bank statements. Next, grasp core accounting and finance concepts that every manager needs to know. Absorb beginner lessons on financial statements, accruals, assets, and more. Finally, elevate your tax knowledge with a professional diploma covering income tax, VAT, payroll, and beyond.

With three highly-rated courses packed with insider tips, you'll confidently handle accounts, make strategic decisions, and explore lucrative roles like Tax Accountant. Supercharge your employability and become a finance whiz today.

Learning Outcomes:

- Master Xero accounting software used by over 3 million businesses globally

- Produce financial reports like balance sheets, income statements, and VAT returns

- Understand double entry bookkeeping, accruals, depreciation, and accounting principles

- Learn how to submit self-assessment tax returns and manage payroll

- Gain essential finance knowledge for managerial decision making

- Explore career options like bookkeeper, management accountant, and tax advisor

- Earn industry-recognized certifications to boost your resume

Courses Included:

- Course 01: Xero Accounting and Bookkeeping Course

- Course 02: Accounting and Finance Course for Managers

- Course 03: Tax Accounting

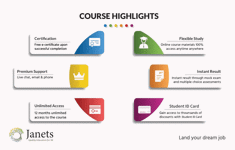

Standout features of studying Tax Accounting and Finance with Xero Accounting & Bookkeeping bundle with Janets:

- The ability to complete the courses at your own convenient time

- Online free tests and assessments to evaluate the progress

- Facility to study from anywhere in the world by enrolling

- Get all the required materials and documentation after getting enrolled

- Get a free E-certificate, Transcript, and Student ID

- Expert-designed with video lectures and 24/7 tutor support

CPD

Course media

Description

This all-in-one Tax Accounting and Finance with Xero Accounting & Bookkeeping bundle empowers you with in-demand finance skills. Learn Xero accounting inside out, grasp core accounting and finance concepts for managers, and elevate your tax knowledge with a professional diploma. Produce financial reports, submit tax returns, make strategic decisions, and supercharge your career.

So what are you waiting for? Enrol in Tax Accounting and Finance with the Xero Accounting & Bookkeeping bundle now and launch your career with a bang.

Course Curriculum:

Tax Accounting Diploma

- Module 01: Tax System and Administration in the UK

- Module 02: Tax on Individuals

- Module 03: National Insurance

- Module 04: How to Submit a Self-Assessment Tax Return

- Module 05: Fundamentals of Income Tax

- Module 06: Payee, Payroll and Wages

- Module 07: Value Added Tax

- Module 08: Corporation Tax

- Module 09: Double Entry Accounting

- Module 10: Management Accounting and Financial Analysis

- Module 11: Career as a Tax Accountant in the UK

Accounting and Finance Course for Managers

- 1. Introduction

- 2. First Transactions

- 3. T Accounts introduction

- 4. T-Accounts conclusion

- 5. Trial Balance

- 6. Income Statement

- 7. Balance Sheet

- 8. Balance Sheet Variations

- 9. Accounts in practise

- 10. Balance Sheets what are they

- 11. Balance Sheet Level 2

- 12. Income Statement Introduction

- 13. Are they Expenses, or Assets

- 14. Accounting Jargon

- 15. Accruals Accounting is Fundamental

- 16. Trial Balance 3 days ago More

- 17. Fixed Assets and how it is shown in the Income Statement

- 18. Stock movements and how this affects the financials

- 19. Accounts Receivable

- 20. How to calculate the Return on Capital Employed

- 21. Transfer Pricing – International Rules

Xero Accounting and Bookkeeping Course

- Introduction

- Getting Started

- Invoices and Sale

- Bills and Purchases

- Bank Accounts

- Products and Services

- Fixed Assets

- Payroll

- Vat Returns

- Next Steps and Bonus Lesson

Method of Assessment

To successfully complete the courses, students will have to take an automated multiple-choice exam. This exam will be online, and you will need to score 60% or above to pass the courses.

After successfully passing the course exam, you will be able to apply for the certificates as proof of your expertise.

Certification

All students who successfully complete the courses can instantly download their free e-certificate. You can also purchase a hard copy of the certificate, which will be delivered by post for £15.99.

Who is this course for?

The Tax Accounting and Finance with Xero Accounting & Bookkeeping bundle is ideal for:

- Aspiring bookkeepers and accountants seeking a Xero certification

- Managers and business owners who want to better understand finance

- Career changers transitioning into accounting roles

- Finance professionals expanding their tax accounting expertise

- Anyone aiming to pass self-assessment tax exams or become a tax advisor

Requirements

No prior qualifications are needed for learners to enrol on this Tax Accounting and Finance with Xero Accounting & Bookkeeping bundle.

Career path

After completing this Tax Accounting and Finance with Xero Accounting & Bookkeeping bundle, you will have the knowledge and skills to explore trendy and in-demand jobs, including:

- Bookkeeper - £20,000 to £30,000

- Assistant Accountant - £22,000 to £45,000

- Management Accountant - £30,000 to £60,000

- Tax Accountant - £40,000 to £75,000

- Finance Director - £65,000 to £120,000

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.